My Business Automated

Get 50 sales reps working for a fraction of typical cost.

Operate Continuously 24/7

Maintains Uninterrupted Communication

Requires No Downtime

Insuring Immediate Response

Powerful Automation

Tailored Marketing

AI-Driven Marketing

Support & Training

What We Offer:

Meet Your Favorite

New Employee

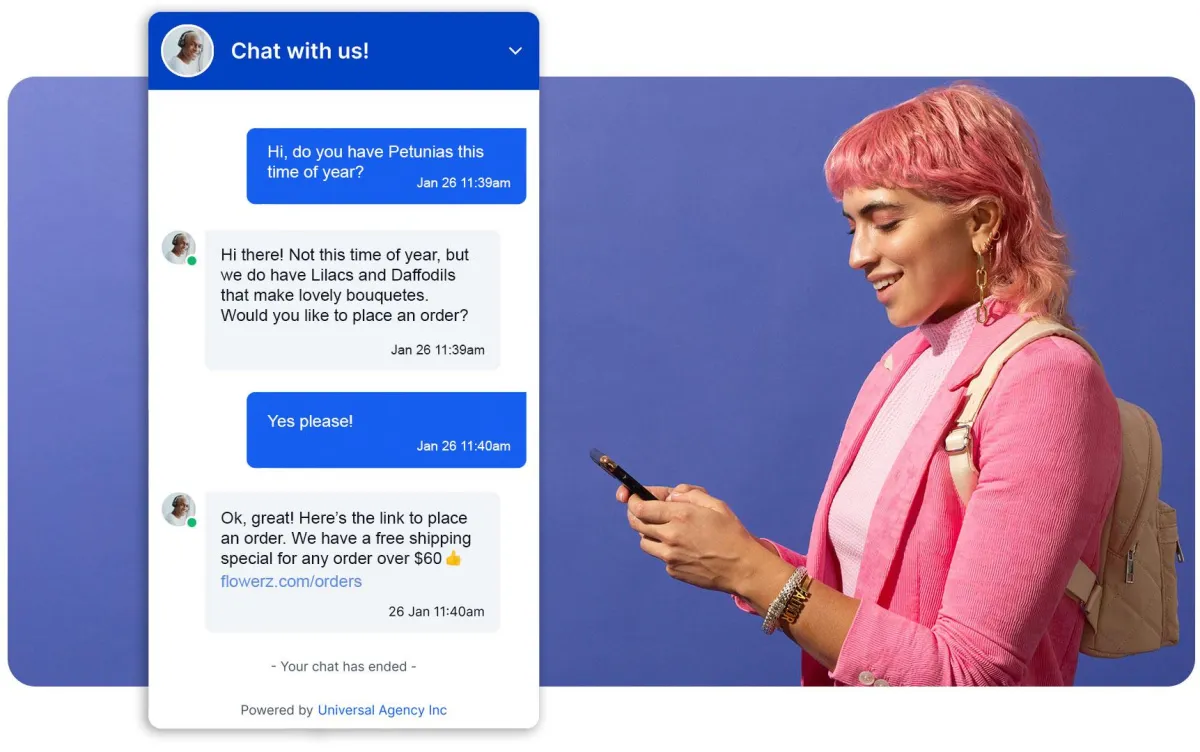

A fully-trained AI Chatbot that:

In today's fast-paced digital environment, the traditional methods of gaining business online are no longer sufficient. My name is Jeff Egberg, and I'm here to guide you through the frontier of online business automation that's not just about keeping up but being a leader in your industry.

Imagine integrating your business operations with advanced technology that manages your bookings, organizes your calendar, and automates routine tasks. Yes, we're talking about AI-driven solutions that are reshaping how small to medium-sized enterprises operate online.

High Level, a platform that has soared from inception to a billion-dollar valuation in just six years, exemplifies this growth. Yet, many businesses around the globe remain unaware of such tools at their disposal. Today, I challenge that status quo by introducing you to a suite of over 300 tools, all accessible from a single point—transforming complexity into simplicity.

Comprehensive Training and Support -

Unlike traditional support structures, our approach is hands-on and personalized. We don't just give you tools; we train you to use them effectively.

Time and Cost Efficiency

We understand the value of your time. Our services are designed to deliver maximum efficiency for a minimal investment, starting from a few hundred dollars a month, tailored to your industry needs.

Guaranteed Satisfaction

The confidence in our method is so high that we offer a 100% money-back guarantee if it does not exceed your cost expectations. This is our commitment to you, because your success is our success.

All-in-One Platform

From marketing automation to customer relationship management and beyond, everything you need to manage and grow your business online is here.

Industry Agnostic

Whether you're in retail, manufacturing, or any other sector, our tools are designed to bring you business, not just traffic.

Serious Clients for Serious Businesses

We help you filter out the noise, connecting you only with serious clients who are ready to engage with your services, maximizing your productive business

Easily Trained

We'll help you train your website, FAQs, and even Google Docs

Easily Taught

Any responses you don't like, the AI Chat bot will ask you how it should have replied

Easily Customized

Customize the look and feel of your chatbot to match your company's branding

Test and adjust

Privately converse with your bot to test and tweak replies

Powerful AI Models

Your chatbot runs on the latest and greatest of GPT models

Private & Secure

Your data is hosted on secure servers with robust encryption and access control.

Empower your service with Technology that adapts and evolves by analyzing your customers' inquiries and interactions.

73% of users

Experience of customers searching websites like the convenient interactions of Chats bot

74% of internet users

favor chatbots for resolving straightforward inquiries.

87.2% of consumers

describe their experiences with bots as neutral or positive.

3X faster

Chatbots have remarkably accelerated response times, answering 3 times faster on average.

Right Answers, Right On Time. Never miss a contact

Generate more leads with no additional advertising budget! How AI converts more leads to sale - from the benefit of the business perspective. Example get them qualified first before you even schedule a discovery discussion.

Looking for more time? Sure you are!